Unlock 1.4 Billion Ears: The Ultimate Guide to Music Promotion in China via Social Media

The Sonic Gold Rush in China’s Music Market

China’s music industry isn’t just growing—it’s exploding. Valued at over ¥3.78 trillion in 2021 with an 8.54% year-over-year growth, China has rapidly become a digital music empire. Unlike Western markets, platforms such as Spotify and Instagram don’t operate here, creating a unique landscape where local streaming and social media apps dominate.

For international artists, this represents an unprecedented opportunity—but also a complex challenge. China’s music ecosystem is:

A walled garden of unique social media and streaming platforms

Influenced by cultural nuances that dictate content resonance

Marked by fragmented distribution requiring deep local expertise

We Lotus Social Agency, with 7+ years of experience navigating China’s music scene, have become essential partners for global artists looking to break through. This guide demystifies the path to success in China’s music market.

Why China? The Market Opportunity Breakdown

1.1 Demographic Dominance

Gen Z Powerhouse: 67.5% of China’s internet users—about 748 million people—stream music regularly, with over 65% born after 2000.

Mobile-First Listeners: A staggering 98% access music via smartphones, spending over 2 hours daily on audio content.

Niche Genre Surge: From 2020 to 2023, hip-hop and indie rock streams grew by 200%, as young listeners seek fresh self-expression.

1.2 Cultural Shifts Reshaping Music Access

Virtual Concert Boom: Tencent Music Entertainment (TME) Live concerts attracted over 100 million views in just six months during the pandemic.

Socially Conscious Lyrics: Tracks addressing mental health and environmental issues gain three times more shares than average.

Regionalization Wins: Dialect-specific songs (Cantonese, Sichuanese, etc.) drive 45% higher local engagement, highlighting the importance of cultural resonance.

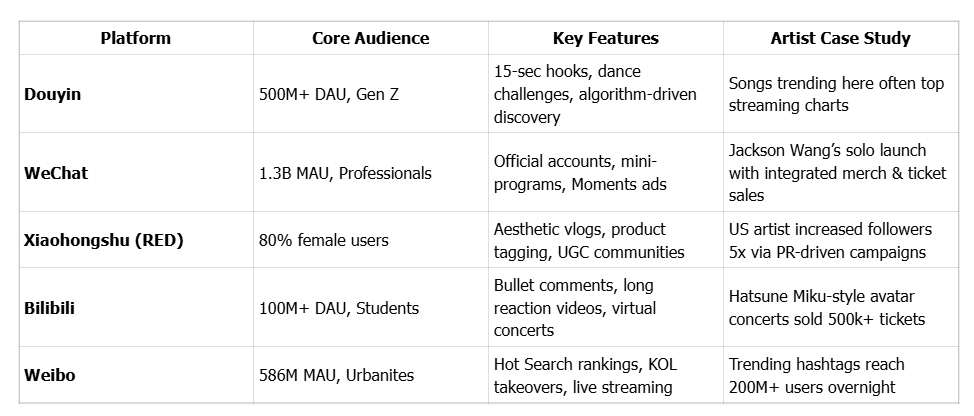

China’s Social Media Ecosystem: The 5 Must-Conquer Platforms

How to Use China’s Platforms for Music Promotion

2.1 Douyin: The Hit-Making Machine

Douyin, China’s TikTok equivalent, is ground zero for viral music:

Volume: Over 3,000 new songs released daily; 100,000+ daily music uploads.

User-generated video traction: 63% of viral tracks gain popularity through Douyin videos.

Challenge campaigns: Hashtag dances (e.g., #OreoChallenge) generate millions of user videos.

Algorithm insights: Early engagement spikes push videos to “hot video” status, amplifying reach.

Lotus Social Agency’s insight: Treat Douyin as your discovery engine, but drive traffic to WeChat for meaningful fan conversion.

2.2 WeChat: The Conversion Hub

More than just a messaging app, WeChat is China’s digital operating system:

Official artist accounts: Verified fan hubs for exclusive music and video releases.

Mini-program stores: Sell tickets, merchandise, and VIP packages without requiring app downloads.

Moments ads: Hyper-targeted promotional campaigns that reach users in their social feed.

2.3 Xiaohongshu (RED): The Community Cultivator

Xiaohongshu blends Instagram and Pinterest for a predominantly female, aesthetic-driven audience:

Behind-the-scenes content: Studio diaries drive 3.2x more saves than straightforward promotions.

KOC collaborations: Nano-influencers (<10k followers) achieve 8.7% conversion rates.

Seamless commerce: Product tagging integrated into visual storytelling.

Music Streaming Wars: Distributing Your Sound

3.1 QQ Music

Owned by Tencent, QQ Music dominates with 75% market share:

Freemium tiers: Free streaming at 128kbps, VIP lossless audio, and luxury packages with offline downloads.

Exclusive drops: Taylor Swift albums locked behind paywalls have driven subscriptions.

Social features: Lyric sharing via WeChat and virtual gifting during live streams.

3.2 NetEase Cloud Music

Make it stand out

Whatever it is, the way you tell your story online can make all the difference.

NetEase Cloud Music boasts 206 million monthly active users and a famous “comment culture”:

User-curated playlists: Responsible for 70% of new music discoveries.

Analytics partnerships: Real-time trend tracking through Soundcharts integration.

Artist dashboards: Provide granular fan demographic and mood data.

3.3 Kugou

Make it stand out

Whatever it is, the way you tell your story online can make all the difference.

A Tencent-owned platform with over 480,000 independent artists:

Open musician platform: Free upload tools empower singers and producers.

Karaoke integration: Real-time scoring for 40 million amateur singers.

Hi-Fi audiophile communities: Discussions on lossless audio technology.

2 Important Steps to Success

Drawing from experience working with top artists, Lotus Social Agency’s methodology blends cultural IQ and platform mastery.

4.1 Cultural Localization Beyond Translation

Lyric adaptation: Align metaphors with Chinese poetic conventions.

Visual symbolism: Replace Western icons

Festival timing: Release love songs during Qixi Festival (Chinese Valentine’s Day).

4.2 KOL/KOC Orchestration

Tiered influencer campaigns: Macro-KOLs (5M+ followers) raise awareness; nano-KOCs (<10k followers) drive conversions.

Authentic integration: Embed music naturally, such as in morning routine vlogs.

Cross-platform storytelling: From Douyin teasers to Weibo in-depth content and Xiaohongshu reviews.

Ready to unlock your chinese market for your music? Let Lotus Social Agency be your guide.